The value of domestic currency dropping is good news for exporters. Sounds weird, fair enough! The process is that when the price of the Pakistani rupee drops, the labour, resources, raw material and manufacturing happening within the country becomes cheaper. As a result, exporters after issuing the payrolls receive higher profits.

This is why, reports suggest, developing countries with depreciating currencies for long periods develop faster.

Thus a situation majorly harmful for a country in debt, for salary taking population and as a whole a demeaning position turns out to be an opportunity in disguise for the export sector. Primarily, the IT export sector.

The recent boom in the exports of knowledge-intensive services elevated Pakistan’s economy in a time of crisis.

Pakistan has been changing its policies according to the innovations brought by IT and other tech sectors. A few of the noticeable efforts by the governments to facilitate IT exports are mentioned.

- Rs 10 billion funds established for IT industry

- Rebate cash rewards of Rs 4 billion for IT exporters.

- Rs 1 billion is being spent on training and capacity building to graduate employable staff through a carefully curated 5-month course.

- Formation of e-commerce council under Ministry of commerce.

- $25,000 can now be brought in home remittance increasing it 5x.

- Pakistan is now listed on Amazon as a seller.

- Pakistan Post digitalizing process started.

The most supporting regulation for IT businesses was the complete tax exemption on IT exports. The Government of Pakistan, instead of incentivizing the rising sector, has taken back the only relief it had available.

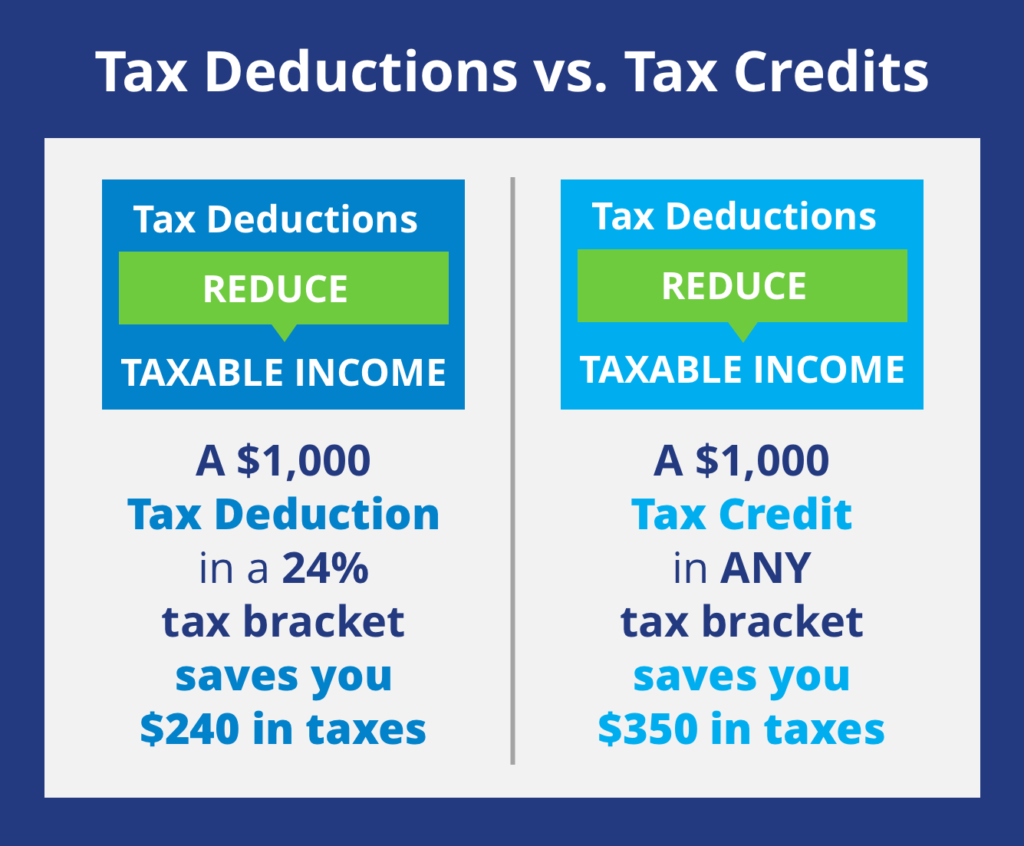

Tax exemption has been converted to 100% tax credit over income tax liability.

What is it, How is it different from tax exemption, why is it receiving such a backlash, and why does the government consider it a successful policy?

Let’s dive deep to know all about it.

What is 100% tax credit?

A tax credit is an amount of money that taxpayers can subtract directly from taxes owed to their government. A 100% tax credit should mean tax exemption, but no, it comes with a vigorous documentation process making things difficult for beginners primarily.

6 conditions for 100% Tax Credit

Income from the export of computer software, IT services, and IT-enabled services are subject to 100% tax credit. The tax credit regime requires compliance on the following aspects:

- The exporter of IT services (the taxpayer) is required to bring 80% of the foreign receipts back to the country through normal banking channels.

- 100% tax credit is available up to June 30, 2025.

- Annual Income tax returns are filed.

- The company applying for tax credit should be 100% withholding compliant w.r.t all expenses; procurement, rent, subscriptions and salaries etc.

- The taxpayer has filed with FBR the withholding tax statements for the immediately preceding tax year.

- Sales tax returns are filed (though sales tax is exempted on the export of IT services).

Why did Government shift to a tax credit regime?

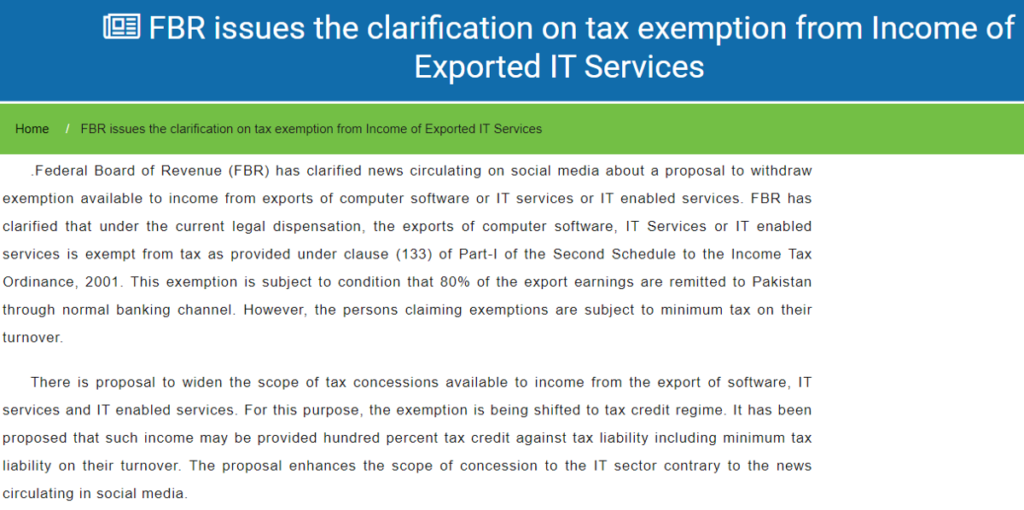

Prime Minister approved the withdrawal of 80 income tax exemptions in April 2021 under the Income Tax Amendment Bill 2021, the IT sector being among those. The tax exemption was supposed to be valid up till June 30, 2025. There are a few reasons for this shift.

- The International Monetary Fund (IMF) has asked Pakistan to withdraw income tax exemptions worth Rs 140 billion to meet the requirements of the revival of a $6 billion IMF program.

- The government claims the proposal enhances the scope of concession to the IT sector contrary to the news circulating in social media.

- Increases the number of tax filers.

- It would provide a definitive record of how much tax exemption is being provided.

- It plugs existing loopholes in the system making the tax code simple and introducing automation to make the revenue system transparent.

The requirements seem to be the basics that most IT startups and well-established businesses are already doing. Those not doing these necessities are going against the laws.

Why is it then, that this news was taken with loud oppositions from all concerned parties?

Concerns of the IT sector

The IT industry has shown strong concerns regarding the many conditions that the tax credit is subject to.

Ambiguity in implementation of 100% tax credit

Policies have hardly been Pakistan’s issue, it is the implementation that always lags.

With the simple process of tax exemption, big companies like DPL, S&P Global and Teradata have fought lawsuits developed due to a lack of industry knowledge of tax officers, causing them millions of dollars.

With the credit regime, things would get further confusing, negotiations becoming part of the definite process causing resistance in IT enthusiasts and hurdles for existing IT companies.

Stakeholders not involved in the decision-making process

The news came as a surprise to the Ministry of IT & Telecom, Pakistan Software Houses Association for IT & ITES (P@SHA) and all other stakeholders.

Regulations changed mid financial year

The tax exemption was withdrawn abruptly giving no time to startups and SMEs to create strategies. The change in policy middle of a financial year creates ambiguity in a lot of aspects.

Probability of net Operating Losses (NOL)

NOL is the result when a company’s allowable deductions exceed its taxable income within a tax period. For novice startups and SMEs, given the documentation and tax filing, it is highly probable to happen since we have already seen that in the case of NonProfit Organisations in Pakistan.

Inconsistent tax policies make Investors reluctant

It highly damages current foreign investors’ confidence in the Pakistani market and averts potential investors as well.

Effects on the sector’s export revenue growth

In spite of the Government’s facilitating tax regime, the IT sector experienced a great growth trajectory with the exports reaching $2.12 billion in the 2020–2021 fiscal year. This shift might have a catastrophic effect on the growth since Pakistan’s IT industry is still in its early stages.

Effects on cost and ease of doing business

This new regime would increase the cost of doing business for reporting companies which are hardly 20% of the total existing. Requirement for an accountant for handling compliances would further increase the cost essentially for startups and SMEs.

The lengthy procedures, frequent notices and law actions would significantly decrease the index of ease of doing business in Pakistan.

The government’s policy update is all good if implemented accordingly, but let’s be honest, we haven’t been able to implement the simplest of regulations. Pakistan doesn’t seem ready to carry out a tax credit regime as of now.

The IT sector claims it has not been facilitated with provisions such as cashback on exports, subsidized electricity tariffs, loans on lower interest rates that other export sectors have been utilizing.

Other countries in the MENA region offer incentives to their IT sectors. Bangladesh offers a 10% cash reward on IT exports along with a tax exemption. On the other hand, China and India have dedicated Special Economic Zones for the IT sector providing several incentives including tax reliefs.

The demands of the IT sector are justified since they highly contribute to the country’s economy.

The shift to tax credit though introduced for the advancement of the IT sector are expected to cause a catastrophic impact on IT revenue growth. Talks between the IT sector and the Government can form a solution that benefits both parties.